Understanding the Difference between Employees and Independent Contractors

September 5, 2023

As a business owner or employer, it's crucial to understand the distinction between employees and independent contractors. While it may seem confusing at times, the proper classification of workers holds significant implications for legal compliance and taxation.

“If you're considering using an independent contractor instead of hiring an employee, you need to understand how these worker classifications differ and what's involved or else you could end up paying a lot in fines” – Samer Khouli

Let’s delve into the main differences between employees and independent contractors, examine the factors used by the IRS to determine worker status, and highlight the risks associated with misclassifying workers.

Differentiating Employees and Independent Contractors

To begin, let's clarify the definitions of employees and independent contractors. An independent contractor, also known as an IC, is an individual who agrees to perform services or work for another while maintaining complete control over the means and methods used.

Independent contractors can be referred to by various names, such as freelancers, consultants, self-employed individuals, entrepreneurs, or business owners. However, the terminology used does not alter their legal status.

On the other hand, employees are individuals who work for a company or employer and receive wages or salaries. They typically have set hours, may be required to work overtime, and are subject to the direction and control of the employer.

Employees are taxed on the income they earn, which is reported annually on a W-2 form. Employers are responsible for withholding state and federal income taxes, as well as FICA tax (Medicare and Social Security) from employees' pay.

IRS Determination Factors

When the IRS determines whether a worker should be classified as an employee or an independent contractor, they consider three key factors: financial control, type of relationship, and behavioral control.

-

Financial Control

This factor focuses on how the indvidual is compensated and whether they have the freedom to work for other businesses. If the worker has the opportunity to make a profit or face a loss based on their work, they are less likely to be classified as an employee.

-

Type of Relationship

The nature of the relationship between the individual and the business is important. While having a contract is significant, it is not the sole determining factor. If the contract includes benefits typically provided to employees, it suggests an employment-style relationship. Additionally, if the work performed is directly related to the core business of the company, it is more likely to be seen as an employee-employer arrangement, rather than an independent contractor classification.

-

Behavioral Control

This factor examines the level of control and direction exercised by the business over the individual. If the business provides specific instructions, training, and dictates the tools or equipment to be used, it indicates an employment relationship. On the other hand, if the individual has the flexibility to set their own hours, requires minimal training, and has autonomy over their methods, they are more likely to be classified as an independent contractor.

By considering these factors, the IRS determines whether a worker should be classified as an employee or an independent contractor. Understanding these factors helps ensure accurate classification and compliance with tax and labor regulations. Your local area may have additional tests or factors to be considered when determining the appropriate classification, so it is important to confirm which test should be used when assessing your workforce’s classification status.

Risks of Misclassification

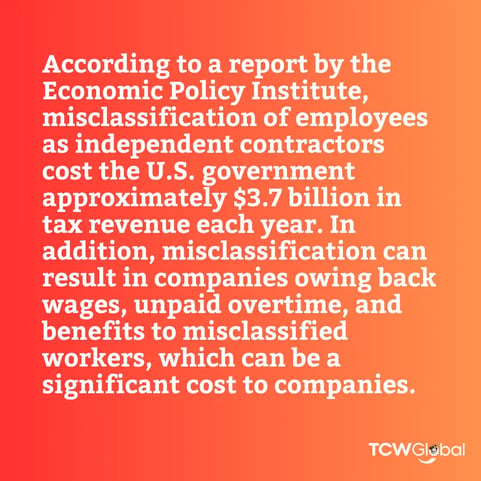

Misclassifying workers can expose businesses to various risks, including tax fines and penalties, audits, lawsuits, and organizational confusion.

-

Penalties:

Misclassification can lead to penalties, including back taxes with interest, and fines of up to 35% of the improperly taxed amount.

-

Audits:

State audits, which are more common than IRS audits, often occur when workers classified as independent contractors apply for unemployment compensation after their services are terminated.

-

Lawsuits:

Misclassified workers may file negligence lawsuits if they suffer job-related injuries. Employees typically have workers' compensation coverage, which prevents such legal actions. -

Lack of Clarity:

Unclear or undocumented company policies regarding the roles of independent contractors can pose risks. If an independent contractor feels they are being treated unfairly or believe they are entitled to employee benefits, they may seek legal recourse or involve regulatory agencies. Implementing clear policies and guidelines helps mitigate this risk.

The More You Know

Understanding the distinction between employees and independent contractors is crucial for businesses to navigate the complex landscape of labor and tax laws.

By familiarizing themselves with the factors considered by the IRS, employers can make informed decisions regarding worker classification, ensuring compliance and minimizing the risks of misclassification.

A proactive approach to accurate classification will help businesses avoid potential penalties, audits, and lawsuits while fostering a transparent and fair working environment.

The Solution to Your Problems

When it comes to managing your contingent workforce and avoiding the pitfalls of misclassification, TCWGlobal is the solution you've been searching for. Our team provides you with a seamless and efficient employer of record service that will make sure your workers are always classified properly.

Don't wait any longer - contact us today at 858-810-3000 or email us at hello@tcwglobal.com to discover how our services can help you achieve your business goals. Let TCWGlobal be your partner in success.