Why Being Compliant Is Better Than “Saving Money” Every Time!

July 7, 2023

Beware of an EOR service that sounds too good to be true.

UPDATE July 28, 2023

U.S. REP. ADAM SCHIFF URGES DEPT. OF LABOR TO INVESTIGATE EMPLOYMENT MISCLASSIFICATION PRACTICES AT DEEL - Read More

Read Congressman Adam Schiff's letter to the US Department of Labor concerning worker misclassification and DEEL - here.

July 7, 2023

In a mounting storm of controversy, Deel.com, the HR startup, finds itself at the center of focus with a California legislator urging the LWDA to launch an investigation.

According to techcrunch.com, prominent California Senator, Steve Padilla, has unleashed a scathing accusation, claiming that Deel has wrongfully classified its employees as independent contractors, thereby depriving them of crucial employee benefits and legal protections.

Worse still, Padilla alleges that Deel appears to be providing guidance to its clients on how to evade taxes and avoid providing employee benefits. The call for accountability within the Employer of Record and Staffing Industry grows louder, highlighting the urgency of holding corporations accountable for such practices and safeguarding the rights of their employees.

In today's business landscape, where financial optimization often takes center stage, it's easy to overlook the importance of compliance with employment regulations. While saving money is undoubtedly a significant goal for any organization, it should never come at the expense of misclassifying workers as independent contractors for both local and global workers.

- Legal Implications

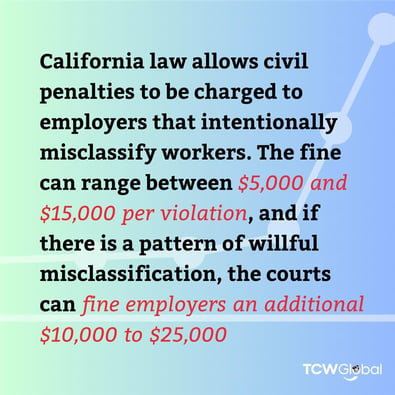

Misclassifying workers as independent contractors can have severe legal repercussions for businesses. Regulatory bodies like state departments of labor and tax authorities are increasingly cracking down on worker misclassification. Violations can lead to hefty fines, penalties, and legal battles that drain a company's resources.

Organizations can avoid these legal landmines by prioritizing compliance and ensuring proper employment and independent contractor classification vetting. These practices will help establish a solid foundation for future growth. - Protections for Workers

Treating workers as employees rather than independent contractors provide them with numerous benefits and protections. Employees are entitled to minimum wage, overtime pay, unemployment benefits, employer tax contributions, and legal protections against discrimination and harassment.

By correctly classifying workers, businesses demonstrate their commitment to treating their workforce fairly, fostering loyalty, and nurturing a positive work environment which results in long-term gains for retention and attraction. - Long-Term Cost Savings

While the immediate focus may be on saving money by classifying workers as independent contractors, the long-term cost implications of non-compliance can be staggering. Expensive Litigation costs, penalties, back taxes, and reputational damage can far outweigh any initial cost savings.

Investing in compliant employment practices from the start safeguards an organization's financial stability and protects against future financial burdens. - Fostering a Positive Company Culture

Businesses can establish stronger relationships when workers are classified correctly. Properly classified workers feel a greater sense of job security, loyalty, and belonging, leading to higher productivity and engagement levels. A compliant workforce promotes positive company culture and strengthens the organization from within, ultimately contributing to long-term success. - Brand Reputation and Consumer Trust

In an era where corporate social responsibility and ethical practices carry significant weight, maintaining a solid brand reputation is paramount. Customers, partners, and stakeholders expect businesses to act responsibly and ethically. Engaging in compliant employment practices demonstrates a commitment to fairness, transparency, and respect for legal obligations.

In the era of ethical and sustainable business practices, compliance with employment regulations forms a crucial part of a company's Corporate Social Responsibility (CSR). Misclassification of workers may reflect poorly on a company's commitment to CSR, which can influence stakeholder and consumer perceptions.

Here are some high-profile cases where misclassifying led to costly fines

- Risk to Sustainable Growth

Misclassification of workers can hinder sustainable growth. The possible legal battles and penalties resulting from non-compliance can derail an organization's financial plan, disrupting long-term strategic goals. Correct classification of workers ensures stability and enables the sustainable growth of the business. - Compliance with Global Employment Laws

As businesses expand globally, they must adhere to international labor laws, which can be extremely complex and vary drastically by location.

The misclassification of workers internationally can lead to international litigation and fines, posing a substantial risk to companies with global operations. Using services like a Global Employer of Record can help ensure compliance with international labor laws, thereby avoiding these potential risks.

A Final Thought

At a time when financial considerations often dictate business decisions, it's critical to remember that being compliant with employment practices should never take a back seat. The importance of correctly classifying workers as employees and/or independent contractors cannot be overstated. By prioritizing compliance, businesses can navigate legal complexities, foster positive workforce relationships, protect their brand reputation, and ensure long-term financial stability.

In the dangerous game of misclassifying workers, the illusion of financial gain shatters in the face of potential losses and punitive fines that loom menacingly, rendering any short-term savings a high-stakes gamble not worth taking.